Deadline: States Meeting 29th September 2021

There is projected to be an increase requirement in expenditure for the States of Guernsey, as things currently stand.

“While many people will argue that the States should cut expenditure or grow the economy before considering raising taxes to fund our public services, the scale of this issue is such that all three routes to more sustainable finances (increasing revenues, reducing expenditure and facilitating growth) are necessary if we are to meet the needs of our community beyond the end of the current political term.” This is from the Policy and Resources Committee’s policy letter due to be debated on the 29th September. See link

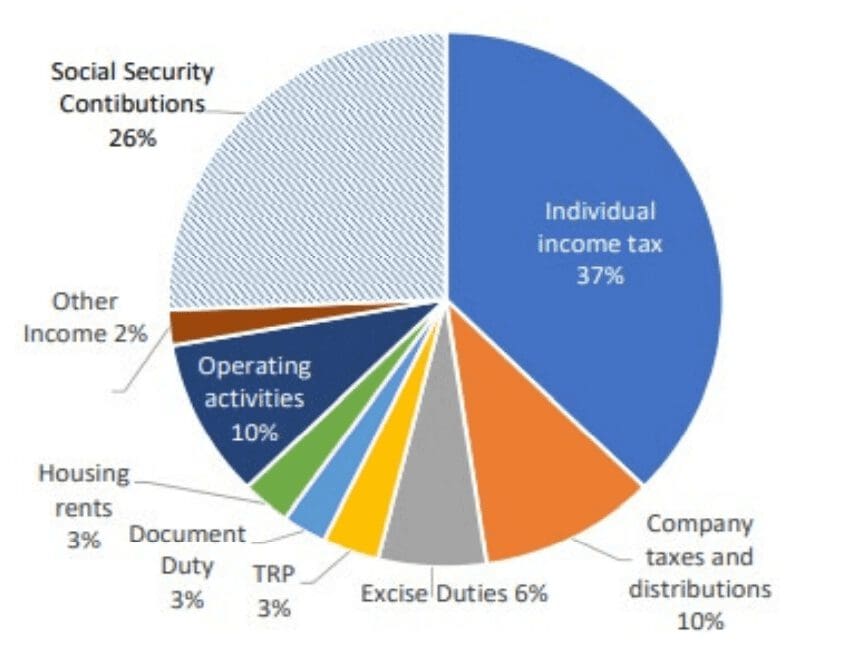

The Policy letter appends the Tax Review Steering Groups technical report and recommendations. This looks at options including the introduction of a general sales tax (GST) as well as changes to contributions and benefits as well as the scope of other taxes.

Comments

There is always concern that the introduction of any tax reforms with have consequences to different groups in society. From the GDA's point of view it is ensuring that those who are on benefits or working but in poverty are not adversely affected by any review.

The proposals in the round have tried to ensure that where there are changes, such as to GST that these are offset in the increases in benefits and in the reduction of contribution payments for those at the lower levels of earnings.

There is a proposal to introduce a "health" tax which would be in name only and not ring fenced for exclusive additional health or social care expenditure.

If you would like to speak to Carol Le Page about any concerns you might have regarding the tax review please contact her by email at carol@disabilityalliance.gg

The debate is due to be held on the 29th September so please let Carol know by Friday 24th September if you have any concerns that you want considered.